Offshore Wind Turbines Can Tame Hurricanes. Yay, Right? Maybe.

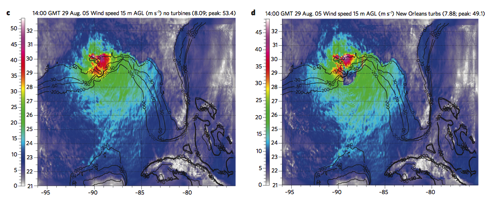

Benefits occur whether turbine arrays are placed immediately upstream of a city or along an expanse of coastline. The reduction in wind speed due to large arrays increases the probability of survival of even present turbine designs. The net cost of turbine arrays (capital plus operation cost less cost reduction from electricity generation and from health, climate, and hurricane damage avoidance) is estimated to be less than today’s fossil fuel electricity generation net cost in these regions and less than the net cost of sea walls used solely to avoid storm surge damage.

With the possibility that anthropogenic global warming is increasing the frequency and/or intensity of hurricanes (a still-ambiguous issue), this seems like a good thing. After all, these wind turbines are built to generate power, and the hurricane-dampening effect would be a pleasant side-effect. Reduced wind speeds and storm surges mean reduced losses of life, property, and resources. Good news, everybody.

But remember that the climate is a complex system with myriad interactions with the ocean, plant/animal ecosystems, aquifers, soil, and on and on. If hurricane impacts are reduced to below the pre-AGW norm, it's highly likely that we'll see some level of unintended cost to environmental systems that had evolved to be dependent upon periodic inrushes of water, high winds (think seed and insect dispersal), or other consequences of hurricane landfall.

If Jacobson et al are correct (and for now, this is entirely model-based -- so probably generally accurate, but with the potential for small-but-important errors), think of this as both an opportunity and a warning. Offshore wind turbines, built to generate electricity, may also have the capacity to measurably reduce the intensity of hurricanes approaching land. As attractive as this sounds, we'll have to be all the more alert to the possibility of upstream ecosystem disruptions.

It will likely come as little or no surprise that

It will likely come as little or no surprise that